tucson sales tax on food

Tucsons sales tax rate is 26 which is over 1000 on a typical new car. The Tucson sales tax rate is.

2021 2022 Sources Of Funds And Uses Of Tax Dollars Pima C

The nations sixth-largest city is ready to begin phasing out an emergency sales tax on food that was added in.

. A 1500 refrigerator purchased in Marana where the sales. Stanfield AZ Sales. To learn more see a full list of taxable and tax-exempt items in Arizona.

Tucson Code Section 19-1301 is repealed effective January 01 2015. As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No. South Tucson AZ Sales Tax Rate.

The December 2020 total local sales tax rate was also 8700. The current total local sales tax rate in Tucson AZ is 8700. 6 hours agoBy his estimates the food tax break and property tax increase would cancel each other out for high earning households with property worth around 500000 to 600000.

Ordinance 11904 was passed by the Mayor and Council on May 25 2022 amending the City Tax Code by extending the additional five-tenths of one percent 05 tax rate increase on certain business classifications for an additional ten-year period through June 30 2032. The South Tucson Sales Tax is collected by the merchant on all qualifying sales made within South Tucson. The money will be used to fix city roads.

The average cumulative sales tax rate in Tucson Arizona is 801. Tucson AZ Sales Tax Rate. Tucson Sales Tax Rates for 2022.

City of Tucson voters overwhelmingly approved Proposition 411 which will extend a half-cent city sales tax for another 10 years. The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 450 city sales tax. The County sales tax rate is.

While the state considers groceries tax exempt according to a recent news article all but about 20 Arizona cities currently tax grocery items. Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement. Rates include state county and city taxes.

The minimum combined 2022 sales tax rate for Tucson Arizona is. Motor vehicle sales to nonresidents of Arizona. Groceries are exempt from the South Tucson and.

However the major cities of Phoenix Mesa and Tucson do not consider groceries taxable. If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower. The December 2020 total local sales tax rate was also 8700.

Tucson the seller owes the sales tax to the City of Tucson whether or not the seller added sales tax to the price of the items sold. You can print a. The Tucson sales tax rate is.

Car purchases made out-of-state also avoid city sales tax entirely upon initial registration in Arizona. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. Wayfair Inc affect Arizona.

And Tucson considered a food tax in 2010 but the city council rejected the proposal. This is the total of state county and city sales tax rates. Groceries are exempt from the Tucson and Arizona state sales taxes.

The Tucson sales tax rate is. Did South Dakota v. Map pdf Public Safety Plan List of Public Safety Expenditures pdf COMMENTS.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The sales tax jurisdiction. 4 Tax Amount Column 5 Net Taxable Column 3 From Sch A on back - Deductions Complete Both Sides of Form Column 2 THIS RETURN IS DUE ON THE 20TH OF THE MONTH.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. The current total local sales tax rate in Tucson AZ is 8700. Tucson Arizonas Sales Tax Rate is 87.

Spring Valley AZ Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v. The sales tax jurisdiction name is Arizona which may refer to a local government division.

Its sales-tax revenue fell from 21 million in fiscal year 2008 to 18 million in fiscal year 2013 and the largest share comes from the retail trade category that includes the food tax. Sales of food products by producers. Sales tax on food and drugs were 4 until January 1980 dropped to 3 that year and to 2 in 1981.

2020 rates included for use while preparing your income tax deduction. The Arizona sales tax rate is currently. What is the food tax in Tucson Arizona.

This page describes the taxability of food and meals in Arizona including catering and grocery food. There is no applicable special tax. The nations sixth-largest city is ready to begin phasing out an emergency sales tax on food that was added in 2010 to address a massive budget deficit.

The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson. This includes the rates on the state county city and special levels. 520-792-2424 Normal Business Operations Monday - Friday 800am - 500pm.

Tucson is located within Pima County ArizonaWithin Tucson there are around 52 zip codes with the most populous zip code being 85705As far as sales tax goes the zip code with the highest sales tax is 85725 and the zip code with the. Tucson Details Tucson AZ is. This includes the rates on the state county city and special levels.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Springerville AZ Sales Tax Rate. The latest sales tax rates for cities starting with A in Arizona AZ state.

You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. While Arizonas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Vehicle purchases can be made at Jim Click Ford in Sahuarita Oracle Ford in Pinal County in Nogales and of course at Casa Grande and Phoenix dealers.

As you can see to obtain a foodbeverage tax in Tucson Arizona FoodBeverage Tax you have to reach out to multiple. The burden of proving that a sale of personal property is not a taxable sale HOW DO I PAY RETAIL SALES TAX. The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson.

You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. A half-cent sales tax increase is estimated to cost each household member in the City of Tucson approximately 3 per month over the course of the five-year period.

Shop Holiday Gifts Health Holiday Shop Holiday Gifts

Understanding Your County Tax Bill If You Live In Tusd Pi

Pin By Lynn Dehlinger On Research Rma Hotel Marketing Convention Centre Tourism

3 99 For A Qt Lunch Bye Waffle House So Hot And Tasty Quick Meals Waffle House Thank You Come Again

Best Tucson Shopping Top 10best Retail Reviews Tucson Catalina Foothills Shopping Destinations

Arizona Sales Tax Rates By City County 2022

Vintage Advertising Ice Pick Icepick From Food Beverage Business Central West Public Service Co Refrigeration Bottle Cap Opener Vtg

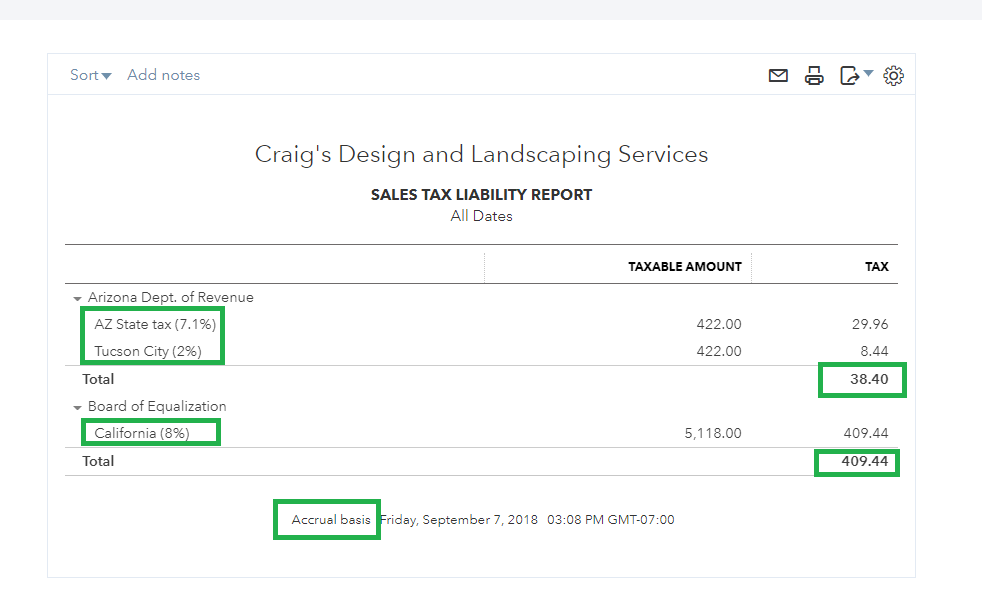

Setting Up For Success With Quickbooks Online Sales Tax In Quickbooks Online

Is Food Taxable In Arizona Taxjar

Arizona Sales Tax Small Business Guide Truic

Grab A Quick Grilled Bite At Ronto Roasters In Star Wars Galaxy S Edge The Disney Food Blog Disney Food Blog Wrap Recipes Roaster

Arizona Sales Tax Small Business Guide Truic

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

Check Out This New 2021 Hyundai Tucson With 10 Miles For Just 27 496 Shoppacar Com Get To The Shoppa Vehicle Details Https Hyundai Tucson Hyundai Tucson

The Coupons App 1 Most Popular Download For Android Iphone Fast Food Coupons Free Printable Coupons Printable Coupons

Lidl Offers 12th 18th November 2015 Catalogues Weekly Specials November 2015 Uk Leading Retailers And Groceries Publish Their Latest Lidl Offer Grocery